If you lost everything, would you remember all of your items?

How to make a home inventory.

Don’t wait. It sounds overwhelming, but here are some easy ways to do it.

Imagine that all your belongings are destroyed in a house fire. Thankfully, you have insurance. But to file a claim and get reimbursed, you have to make a list of everything you lost.

How many of your belongings would you be able to remember?

I tried it on a smaller scale, listing everything I could think of in my home office from memory. I came up with 51 items. Not bad, I thought — but once I returned to the room, I discovered another 25 things that I’d missed.

“All the stuff that we collect as people over the years … adds up to hundreds of thousands of dollars oftentimes. And to remember all those little things is nearly impossible,” says Steve Severaid, president of The Greenspan Co./Adjusters International, a public adjusting firm serving California, Nevada and Arizona. Public insurance adjusters help policyholders negotiate fair insurance claims.

To ensure your claim payout doesn’t fall short, consider creating a survey of your belongings, often called a home inventory.

The benefits of a home inventory

In the aftermath of a disaster, you’ll likely be grieving the loss of your home, looking for a temporary place to live and struggling to figure out what’s next. Aside from helping you get full reimbursement for your possessions, having a home inventory can lighten your burden during a stressful time.

“Is it hard to [make an inventory] now? Yeah,” says Katherine Navarro Wong, a State Farm agency owner in Santa Rosa, California. “But after you’ve lost everything, it’s really hard.”

Because you’ve already done most of the work, having a home inventory in place makes it easier and quicker to file your claim, Wong says. “You’ll get your money faster.”

Putting together your inventory can also help you make sure you have enough insurance coverage. You might not realize just how much your stuff is worth until you start documenting it all, Wong says. Then, if you discover that your personal property coverage isn’t enough, you’ll have time to increase your limit before disaster strikes.

How to create a home inventory

Listing every one of your possessions may seem like a daunting task, but there are ways to make it more manageable.

“One of the … fastest, simplest ways to do this is to take 15 or 20 minutes with a video camera or your iPhone,” Severaid says. He recommends walking through each room and narrating as you go, zooming in on the labels of high-value items. Don’t forget to pull out dresser drawers and open cabinet doors to show what’s inside.

Aside from being quicker to produce than a written record, a video also offers a way for your insurance company to see the quality of your items, Severaid says.

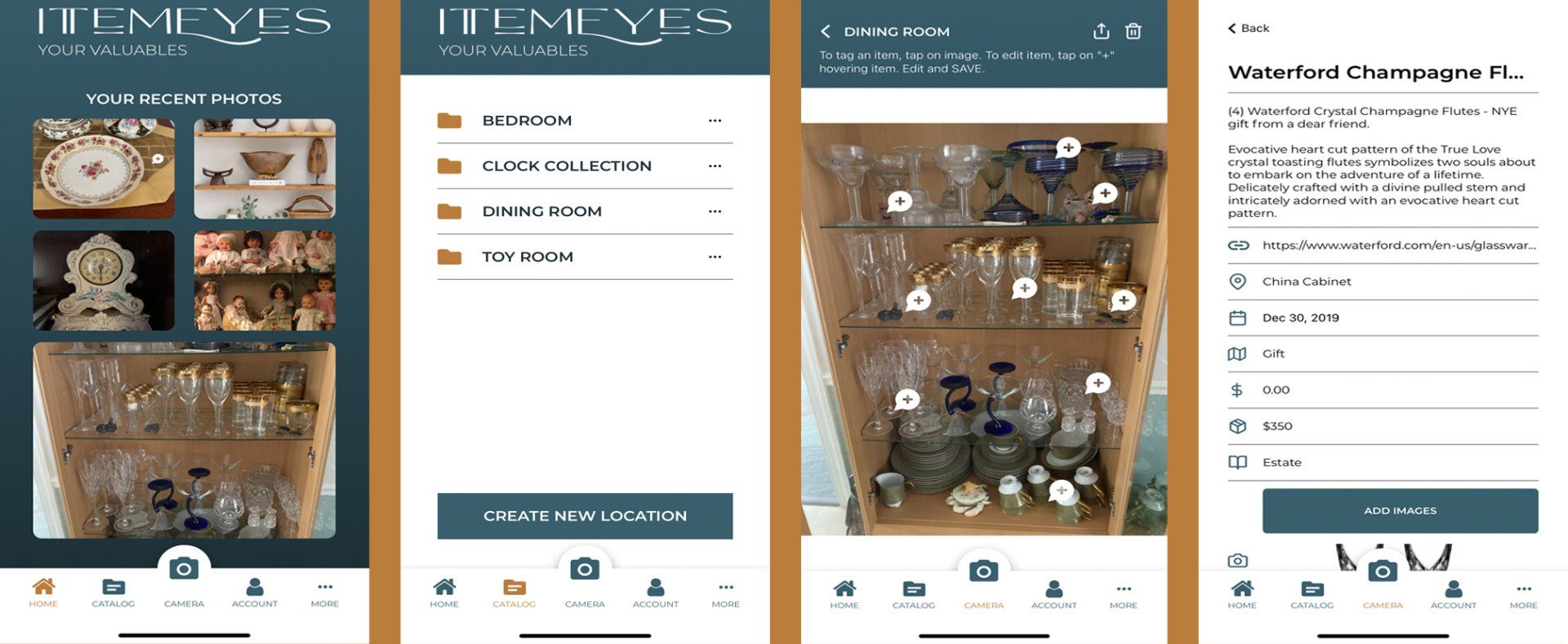

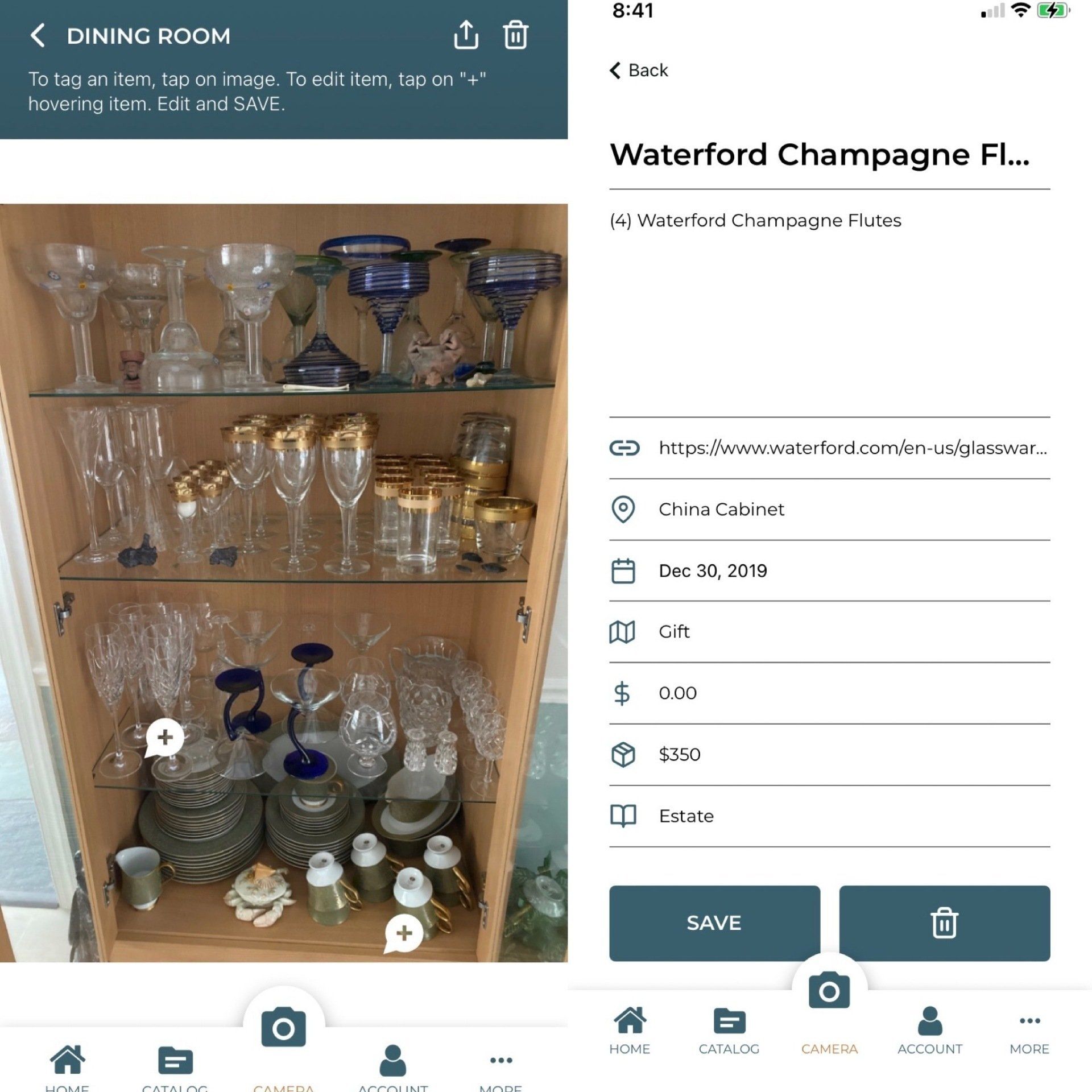

Taking photos instead of video is another option. For example, the ItemEyes app allows you to upload images and information about each item, such as the serial number, date of purchase, warranty, appraisals.

If trying to count every kitchen towel makes you want to give up altogether, “focus on the more valuable items”. This might include jewelry, artwork, musical instruments and collections, plus furniture and electronics. The items in a toolshed can also add up fast.

Whatever method you choose, make sure your home inventory is stored somewhere outside of your house, such as in the cloud or a safe deposit box at the bank. Having an inventory won’t do you any good if the computer it’s on burns up in a fire. The ItemEyes app stores your info as long as your account is active.

You can share your stored ItemEyes info with your insurance agent and/or estate attorney.

It's recommended that you update your inventory every year or two, or sooner if you’ve made major purchases or redecorated your home.

Making a claim without an inventory

If disaster strikes before you’ve gotten around to creating an inventory, you can try the following to get the most from your home insurance claim:

- Ask friends and family to share photos taken at your home. Photographs are never meant to document the house, but it’s always in the background.

- Check your phone (if it survived the disaster) and social media accounts for photos of the interior of your home.

- Look for a list of common household items, such as the United Policyholders inventory above, to help jog your memory.

- Check your order history at the online stores where you shop most often. Your email account may also have receipts for past purchases.

By Sarah Schlichter

We built an amazing organizational tool

This app is simple to use, and brings a world of organization into your life by enabling you to manage all of your valuables and collectibles.